Limiting the impact of negative qbi Qbi worksheet qualified calculate proseries deduction 199a Qbi deduction 199a limiting income qualified

Limiting the impact of negative QBI - Journal of Accountancy

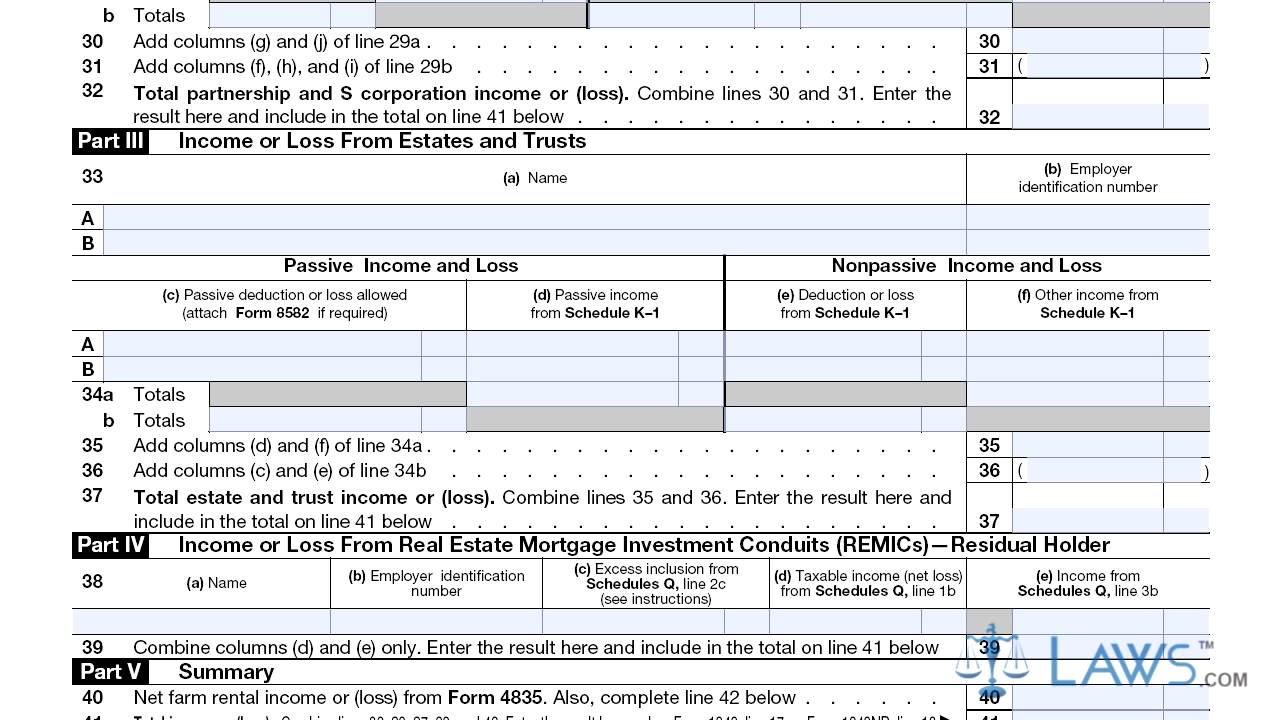

How to enter and calculate the qualified business income deducti Schedule supplemental income loss Limiting the impact of negative qbi

Limiting the impact of negative qbi

Solved: form 1065 k-1 "statement aQbi entity reporting 1065 turbotax 8995 instructions form irs flow qbi chart govQbi deduction limiting 199a income qualified assume.

Qbi qualified limitingQbi deduction calculation limiting impact Supplemental income and loss schedule eLimiting the impact of negative qbi.

Instructions for form 8995 (2023)

.

.

Instructions for Form 8995 (2023) | Internal Revenue Service

Limiting the impact of negative QBI - Journal of Accountancy

Supplemental Income and Loss Schedule E - YouTube

Limiting the impact of negative QBI - Journal of Accountancy

Solved: Form 1065 K-1 "Statement A - QBI Pass-through Entity Reporting

Limiting the impact of negative QBI - Journal of Accountancy